We are pleased to inform you that the HKUST(GZ) Education Foundation has been officially granted tax-exempt status and recognized as a non-profit organization eligible for pre-tax donations deductions. The relevant government authorities have recently released official lists of approved organizations. Details are as follows:

- With the joint approval of the Guangzhou Municipal Finance Bureau and the Guangzhou Municipal Tax Service, State Taxation Administration, the Foundation has been granted Provincial-Level Non-Profit Tax-Exempt Status.

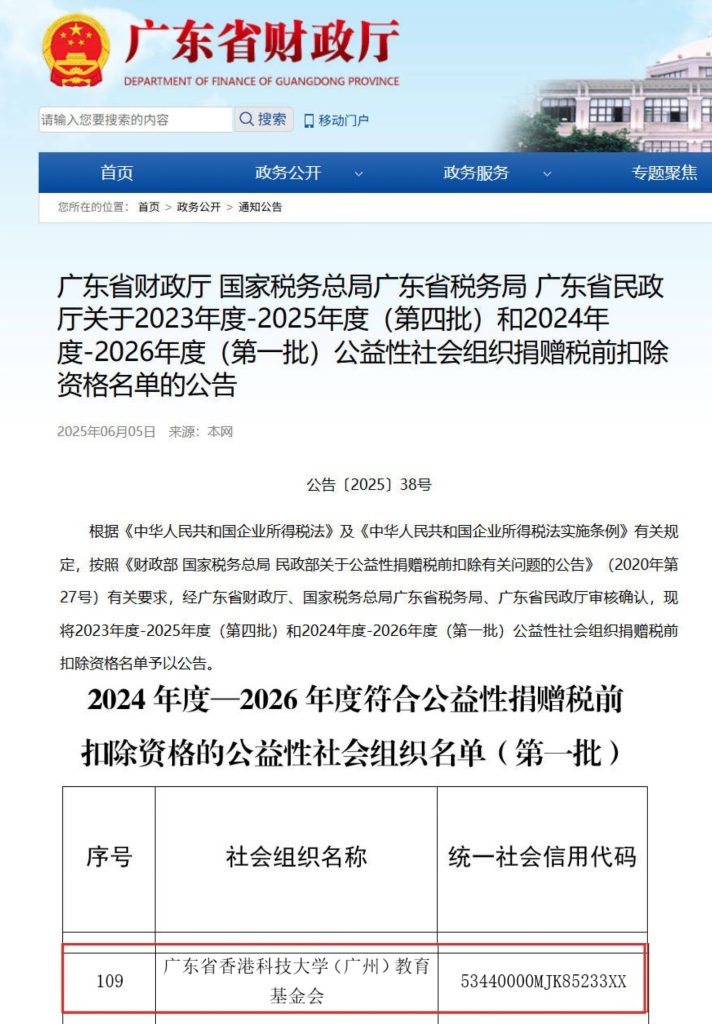

- Simultaneously, the Foundation has also been included in the 2024-2026 (First Batch) List of Non-Profit Organizations Eligible for Pre-Tax Donations Deductions, following a joint review conducted by the Department of Finance of Guangdong Province, the Guangdong Provincial Tax Service, State Taxation Administration, and the Department of Civil Affairs of Guangdong Province.

These recognitions hold significant meaning for the university and our community of donors:

They provide a legitimate and policy-supported channel for tax-deductible donations.

- Corporate donations made through the Foundation may be deducted up to 12% of the company’s annual profit before tax when calculating taxable income. Amount exceeding this limit may be carried forward and deducted within the following three years. (《中华人民共和国企业所得税法实施条例》(国务院令第512号)第五十三条)

- Donations made by individuals from their income to Foundation are eligible for a pre-tax deduction of up to 30% of their declared annual taxable income, in accordance with applicable laws. (《中华人民共和国个人所得税法》第六条)

These qualifications also reflect the Foundation’s strong commitment to compliance, transparency, and responsible governance, and will further strengthen donor confidence, expand philanthropic engagement, and support the advancement of our education, research, and talent development initiatives.

To help donors better understand these tax policies, the Foundation has published a brief article and examples of calculations via the official WeChat account. You are warmly welcome to follow “港科广|基金会与校友事务” on WeChat for more information (Please note that the content is currently available in Chinese only). Should you have any intention to make a donation or require further information regarding donation arrangements, you are welcome to contact us at fadgz@hkust-gz.edu.com. We will be glad to offer our full support.

Thank you for your continued support of the Foundation and our shared commitment to educational philanthropy.

.

The Hong Kong University of Science and Technology (Guangzhou) Education Foundation